News & Market Commentaries

- Home

- News & Market Commentaries

News & Market Commentaries

Commentary Archives

Bad News, Good News, and Some Terribly Good News

New financial index developed by Santa Barbara-based firm and UCLA Professor integrates financial and ESG factors to select US stocks that outperform the broad market while creating positive social change. “The bad news is nothing lasts forever, The good news is nothing lasts forever.” American singer and songwriter J. Cole There has been some bad

Omega Financial Group Launches Argos AlphaEsg Index™ – A New Approach to Sustainable Investing

New financial index developed by Santa Barbara-based firm and UCLA Professor integrates financial and ESG factors to select US stocks that outperform the broad market while creating positive social change. (June 12, 2023) Santa Barbara, CA – Omega Financial Group and its Chief Strategist and CIO, Dylan B. Minor, have announced the Argos AlphaEsg Index™

Omega Financial’s Chief Strategist, Dylan Minor, Appointed Adjunct Professor at Columbia University

Minor has developed new course on ESG & Corporate Political Strategy (September 2023) Santa Barbara, CA – Omega Financial Group, a leading Santa Barbara-based investment firm, is pleased to announce that its Chief Strategist and Chief Investment Officer, Dylan Minor, has been appointed as an Adjunct Professor of International and Public Affairs at ColumbiaUniversity. In

Omega Financial launches new stock index that factors ESG elements

Omega Financial Group did something not many private wealth management groups tend to do on June 12, announcing the launch of its own financial index — Argos AlphaEsg Index. A Santa Barbara-based firm, Omega was founded in 2010 by Dylan Minor, who at the time was completing his Master’s at UC Berkeley. Minor, in addition

Back to School: Using Academia to Unlock Financial Success

In an era of technological disruptions and evolving global dynamics, academia continues to play an indispensable role in guiding the financial and investment industries towards responsible, sustainable, and successful outcomes After recently dropping my daughter off at college, I was reminded how important our universities are. Not only do they provide our youngsters with a

Demystifying the October Stock Market ‘Trick or Treat’: A Data-Driven Perspective

Many generalized ideas about market “patterns”, are mythical when held to the light of data. Soon countless youngsters across the country will be celebrating Halloween. Although the prospect of seeing a scary costume is always present, so too is the fear of a receiving a “trick” over a “treat.” Similarly, October has long been touted

What’s going on?!?

“All you need in this life is ignorance and confidence, and then success is sure.”” Mark Twain Many investment markets are now at a loss this year. And many are at a loss to explain why. The below chart plots the returns year-to-date through October 27th of the SP500 (orange line), International Stocks (white line), US

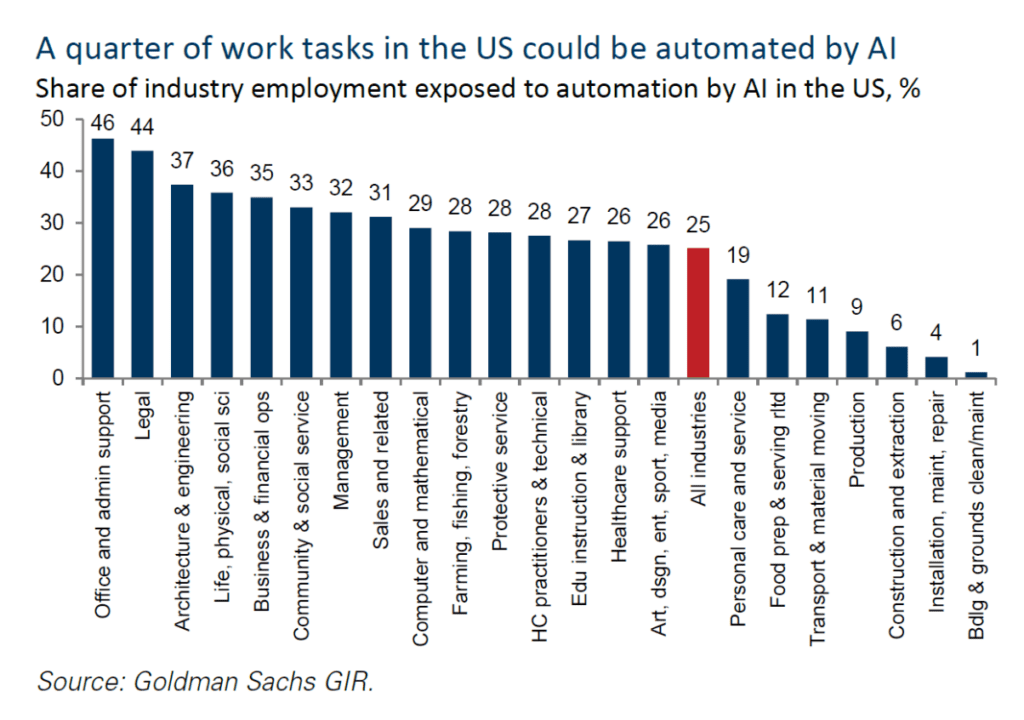

Artificial Intelligence (AI): what it is, where it is, and what we’re doing about it

*Our firm’s AI Market Commentary dated as of 8/19/2023 has been updated with an important footnote because, without additional clarifying information, it can be interpreted as stating that we are using AI more extensively and more directly for investment selection than we intended to represent. Our AI Market Commentary previously stated that, “We are also

The Good, the Bad, and the Confusing

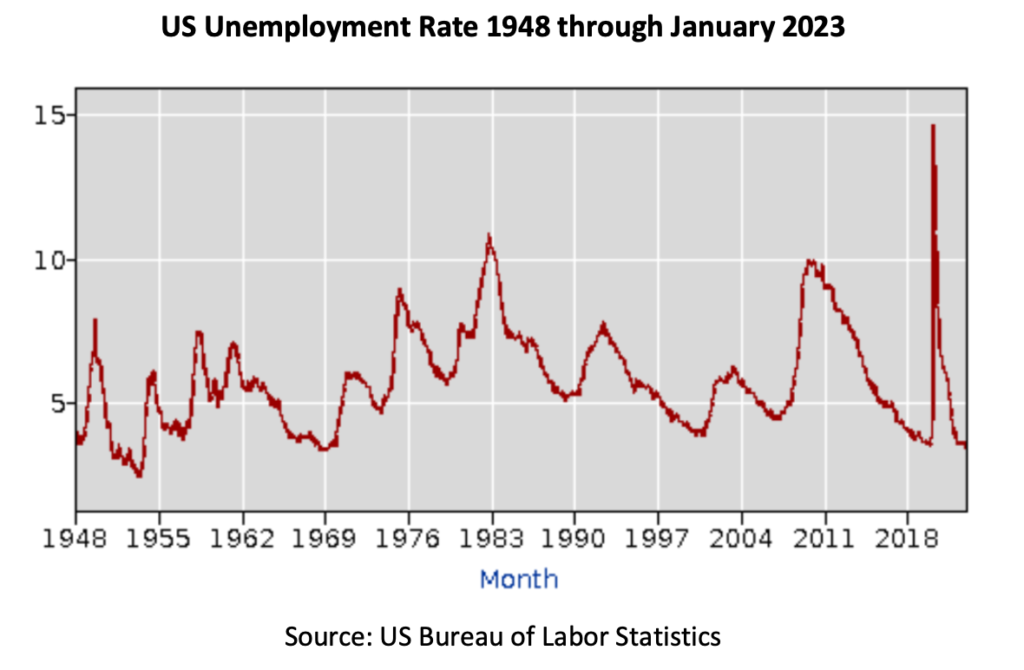

“If you’re not confused, you’re not paying attention.” Tom Peters (author of In Search of Excellence) The Good Have you heard about the recent “terrible” economic news?Unemployment is at its lowest level in over 50 years, as shown by the below graph: Meanwhile, there is still a 2% larger gap between jobs and workers than there was in

The “Old Normal” and What We are Doing About It

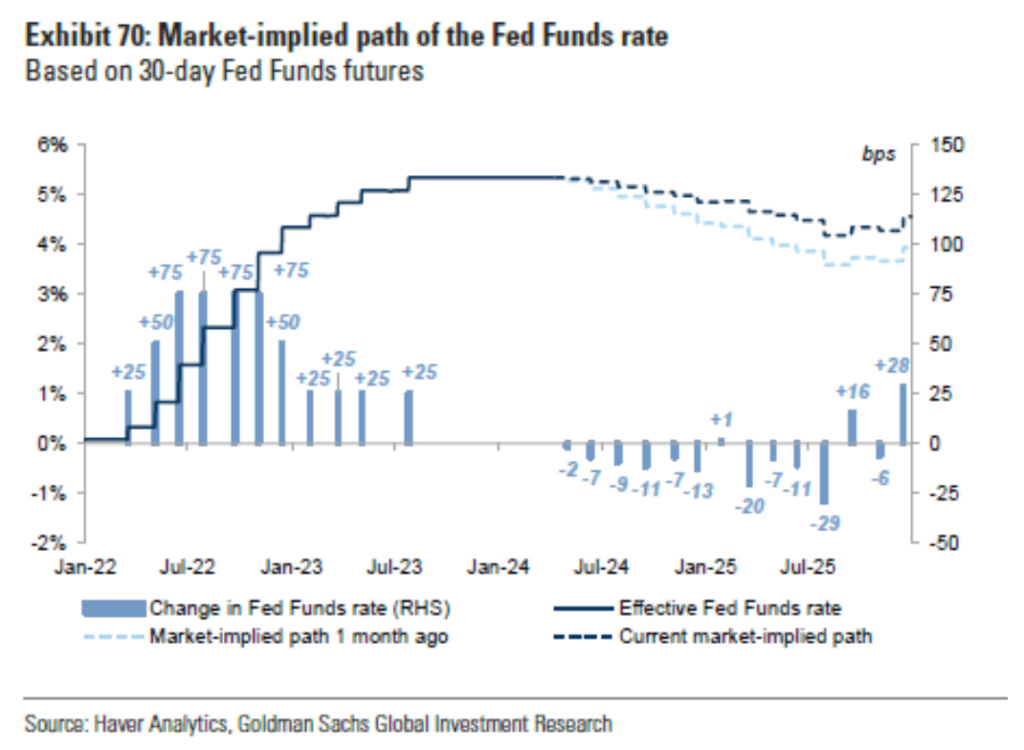

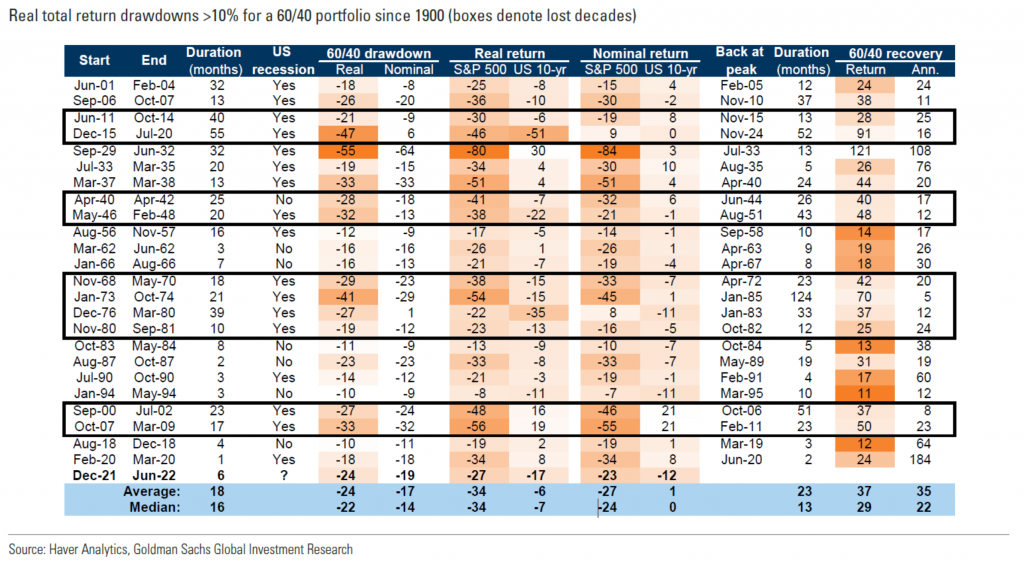

Over these past two decades there has been much discussion about how we are continually entering into a new normal. This year, however, we are back to the “old normal”, at least as far as financial markets are concerned. We are back to a place where one can earn money on their savings accounts. The below