It is our experience that most families build their financial lives in a largely modular way:

- Several retirement plans are funded over several companies over time

- An estate plan is setup

- Annually income tax forms are prepared and taxes are paid

- Multiple investment accounts are funded

- Perhaps a business is founded and being grown

- Cash and debt management is managed through some banks

- Possibly there exists some international domicile or citizenship

Very often these different categories of one’s life are created separately and asynchronously. The result is typically an overall financial life that is inefficient and misses out on extra investment returns, incurs unnecessary risk, pays extra taxes, faces inefficient costs, and limits philanthropic contributions. In practice, a change in one of these areas is inextricably tied to at least one, if not all, of the other areas. The consequence is that a sophisticated integrated plan is needed. We have fashioned and trademarked a process to do just this, which we have dubbed Optimized Wealth Integration®. The final integrated plan is called a metaplan, and is designed to best orchestrate our families’ dreams.

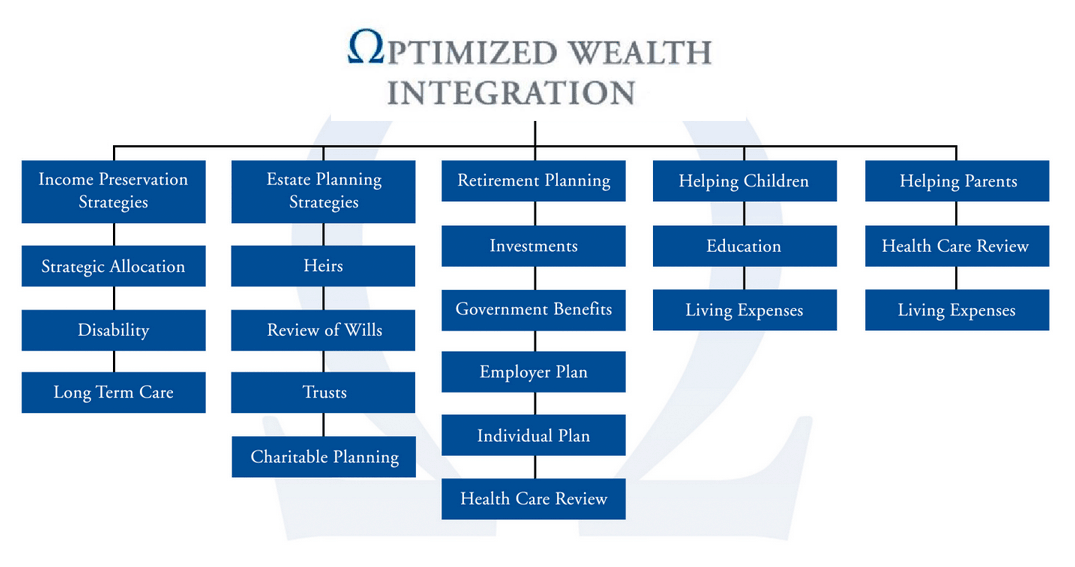

The following graphic shows that even under a simple setting of no business and no global considerations, there are many aspects of one’s life that should be all linked together.