Dylan B. Minor PhD, MSBA, CFP®, ChFC, CLU

Chief Strategist and CIO

Forget not your past, for in the future it may help you grow.

J M Barrie

As they say, hindsight is 20/20. So it is that a look to the past two decades can prove helpful, as we are already 20 years into the 21st century.

I remember quite well the eve of 2000: Some people were sounding alarm bells: We were warned that civilization would soon crack. Many said that the year 2000 would cripple our infrastructure. Some people sold their homes and bought gold. Others bought beans and bullets. And even more filled up their cars at the gas stations the night before 1/1/2000. What happened the next morning? Nothing. Meanwhile, the S&P 500 was trading below 1,500. At that time, the five largest companies, according to Fortune, were: General Motors, Wal-mart Stores, Exxon Mobile, Ford Motor, and General Electric. Fast forward to the end of 2019. Wal-mart and Exxon further advanced and we had some new top five additions. The final list for 2019 was: Wal-mart Stores, Exxon Mobil, Apple, Berkshire Hathaway, and Amazon.com. At this time, the S&P 500 closed 2019 at over 3,200. Of course, there was a lot that happened in between these two bookends, including some terrible times. We had the tragedy of 9/11 in 2001 that forever changed our country. And we had the worst economic crisis since the Great Depression began in late 2007. Here is a quick survey of several more newsworthy events:

2003 The US Invaded Iraq

2004 Facebook was formed, ultimately making social media the way of life for billions

2004 President George W. Bush was re-elected

2005 YouTube was created

2007 Steve Jobs introduced the iPhone, setting off a tidal wave of smartphones that ultimately supplanted parents with Siri and Google for the answers to all of life’s questions

2008 Barack Obama was elected 44th president of the United States, becoming the first African American president

2008 Tesla launched its first car

2009 Omega Financial Group was founded in Santa Barbara, CA

2012 Facebook hit 1 billion users

2012 Obama was re-elected

2016 Britain voted to leave the European Union with Brexit

2016 Donald Trump was elected the 45th president of the United States, surprising many, if not most, pundits

2017 Facebook hit 2 billion users

2018 Apple became the first public company in the universe to be worth $1 trillion

2019 YouTube hit 2 billion users and Millennials prefer YouTube to traditional TV two-to-one

2019 Boris Johnson won a majority in the UK General Election, assuring Brexit

2020 Tesla became worth more than Ford and General Motors combined

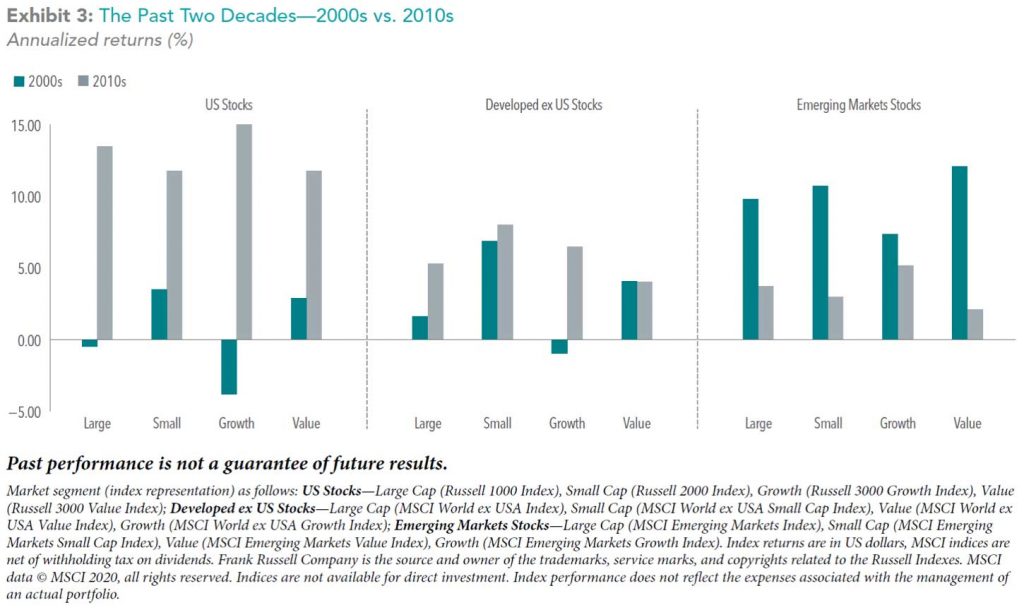

What happened to financial markets along the way during these headlines? We experienced two very different decades. In terms of the largest US stocks, as measured by the S&P500, they on average lost roughly 1% per year from 2000 through 2009, whereas they made over a whopping 13% per year from 2010 through 2019. For the first decade, international markets, especially emerging markets, greatly outperformed US markets. However, in the second decade just the opposite occurred. Similarly, value and smaller stocks outperformed growth and larger ones during the first decade, whereas just the opposite happened during the second decade. The below chart, provided by Dimensional Fund Advisors, summarize this flip-flopping history:

Omega Financial Group LLC is a Registered Investment Adviser. This commentary is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Omega Financial Group LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Omega Financial Group LLC unless a client service agreement is in place.