Dylan B. Minor PhD, MSBA, CFP®, ChFC, CLU

Chief Strategist and CIO

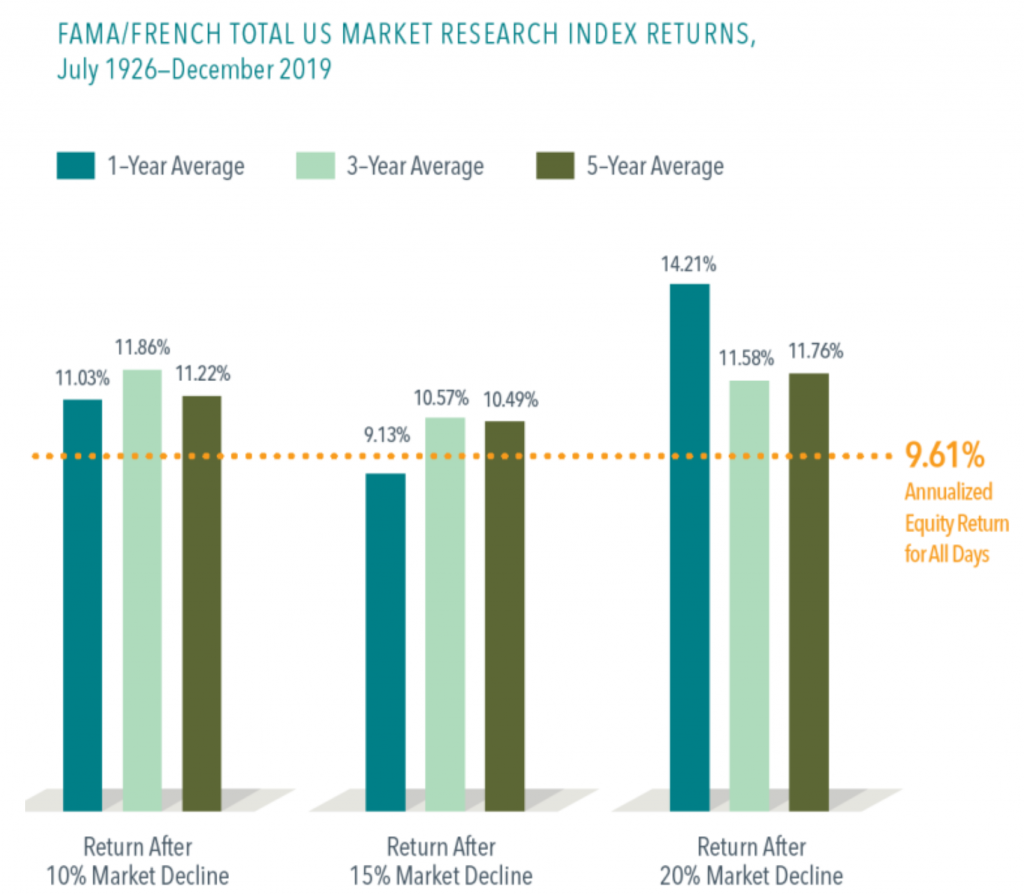

This past Thursday (March 12th) marked the end of the longest bull market, at least by some measures. Stock markets fell 25-30% from previous peaks in February. Interestingly, many of the best returns of the stock market occur after the worst ones. Indeed, the next day, Friday the 13th, equities generated returns of 8-10%. Perhaps these gains will not stick. However, over the long-run, higher returns do tend to happen after a market rout. The following chart shows the average 1, 3 and 5 year annualized return after a 10%, 15%, and 20% loss in stock markets:

Since the middle of 1926 through the end of 2019, US stocks have earned an average annual return of 9.61%. However, after the market falls significantly, future returns tend to be above average, even after five years.

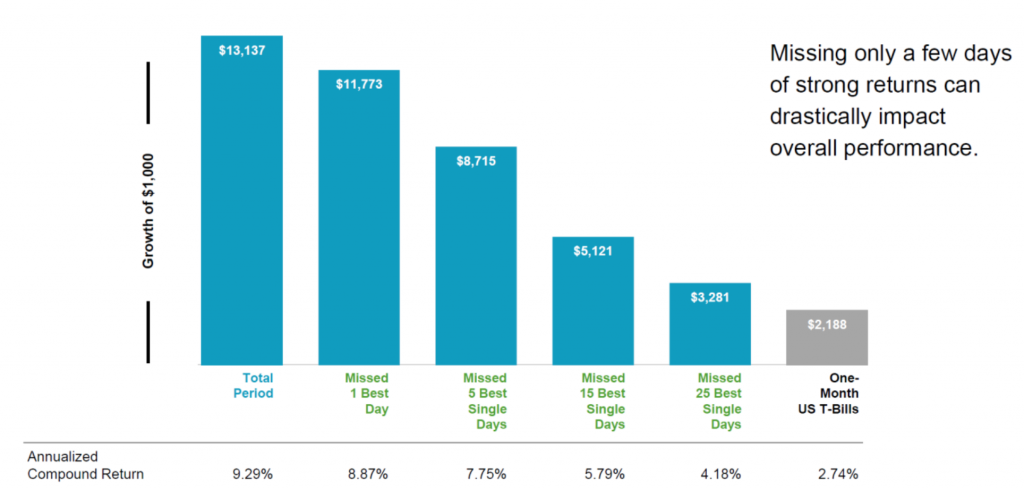

Still, it is nerve racking remaining in markets as they continue to gyrate until they ultimately stabilize and find their way up again. We might ask, why don’t we just go to cash and wait it out? Unfortunately, it is very difficult to time the market, as the below chart illustrates:

Over this period of time (i.e., 1990 through 2018) there were over 7,000 trading days in the stock market. However, missing the best 25 resulted in losing some 75% of the total value of an account. That is, some 3% of the days created about 75% of the wealth. This shows how it is so difficult to time the market.

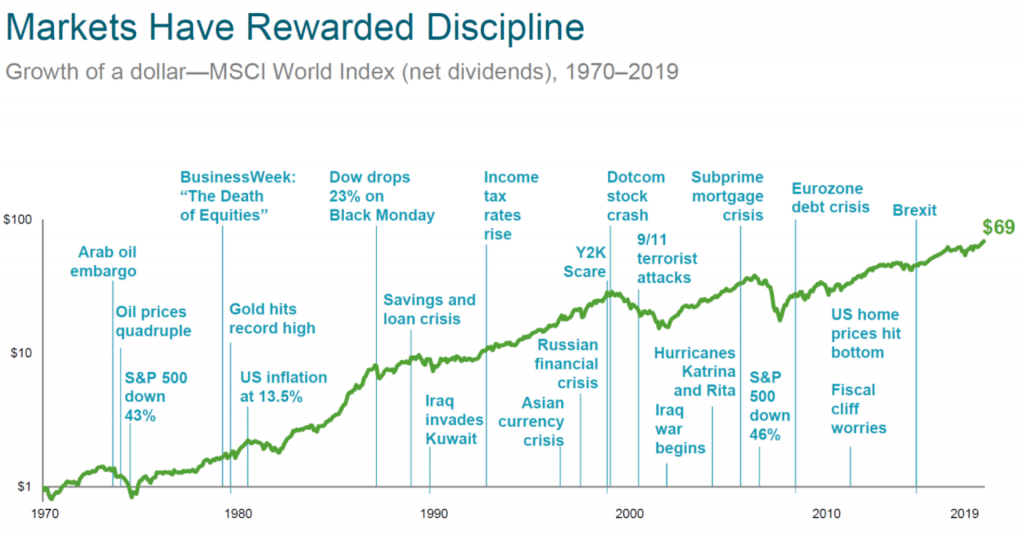

The fact of the matter is that there will always be crises. Indeed, the following chart collects a variety of crises we have faced over the past 50 years:

I remember times such as Y2k, the beginning of the end of the dot-com bubble, when people were stocking up on food and gas, similar to some people now stocking up on toilet paper and peanut butter. I recall the financial crisis when stocks fell over 50% in the midst of a near collapse of capitalism. I vividly recall the 9/11 attacks on the World Trade Center, as I worked for a short time in the World Trade Center (before the attacks). Through all of these major crises, all of which were distinctly different, somehow, we picked up the pieces and moved on to even higher heights. And I believe we will do so again after COVID-19.

The good news is that our clients have truly different kinds of investments. Indeed, as stocks fell precipitously these past 30 days, many bonds and managed futures were flat to up several percent. As such, when clients need to withdraw money, we generally are able to take it from investments that are not down as much as stocks or even up, limiting the timing-effect of withdrawals. In addition, for taxable accounts, we have begun to harvest tax losses where appropriate to provide some economic benefit from the downturn.

To be sure, COVID-19 will have significant economic implications as people largely stop travelling and limit going out. We will likely spend more money, however, in areas like healthcare and takeout food. But on net I expect a material overall loss to our economy from COVID-19. Some early estimates suggest that US GDP might contract around 5% in Q2. However, as the fog lifts, significant economic advancement during Q3 and Q4 could still allow the US economy to eke out around a .5% gain for the year and continue into 2021 with economic strength. So what should we do in the meantime? We should focus on what we can control: engage in best practices to stay healthy and happy, take advantage of tax harvesting where appropriate, and capitalize on low valuations through rebalancing as appropriate. We do not know when we will be done with the COVID- 19 crisis. But we do know we shall prevail…

Omega Financial Group LLC is a Registered Investment Adviser. This commentary is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Omega Financial Group LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible los of principal capital. No advice may be rendered by Omega Financial Group LLC unless a client service agreement is in place.