Dylan B. Minor PhD, MSBA, CFP®, ChFC, CLU

Chief Strategist and CIO

With most things, the average is mediocrity. With decision making, it’s often excellence. You could say it’s as if we’ve been programmed to be collectively smart.

The Wisdom of Crowds by James Surowiecki

The ‘wisdom of the crowds’ is the most ridiculous statement I’ve heard in my life. Crowds are dumb.

Drew Curtis

Trade wars. Impeachment proceedings. The election. Trade wars. Impeachment proceedings. The election. Trade wars. Impeachment proceedings. The election. And so on. Since I’m sure many of us have recently had our fill of these topics, I decided to turn the focus of this commentary to something different from what the crowds have been focusing on: the crowds themselves.

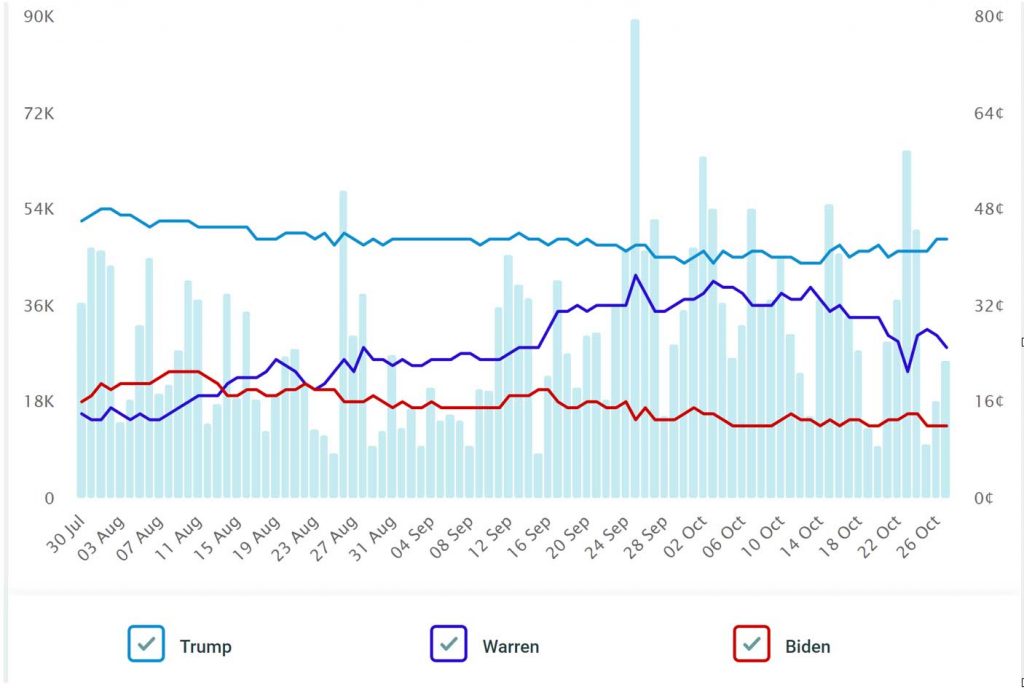

It turns out, sometimes crowds can collectively create wisdom. There is a whole branch of literature by economists that we call prediction markets. These are markets where, often through placing bets, individuals predict what will happen. We have found, especially when a vote is made by money as opposed to a simple survey, they can have some predictive value. Today, there are many such “markets.” One can bet on matters such as when Brexit will happen, if it will be a deal or not, and so on. Naturally, most US political matters can be bet on. One can even bet on something like whether or not, according to NASA, 2019 will end up being the hottest year on record. These markets then imply the probabilities of all these various events occurring. Ok, if you must know, there is currently a 39% implied chance Trump will be impeached by the end of the year, a 43% chance he’ll be re-elected (given all of the current contestants). Below is a chart showing the betting market prices for Trump’s being re-elected in 2020, over the past 90 days. A trade of 45 cents represents a 45% chance of a Trump win, given the other contestants currently in the race. The light blue bars represent the volume of trades at a given time. Large spikes often occur where there is some news that suggests a different probability of a win from before.

Source: Predictit.org

There are many other events for which there are predictions created by crowds. I published a paper on the accuracy of tennis betting markets in predicting professional tennis match outcomes. I found that these markets over a decade predicted the winner roughly 70% of the time. Even in those cases when betting markets forecasted the underdog to win (19% of the time), the market was accurate 63% of the time. Of course, there are many other lesser sports that also have such betting markets, which I won’t waste space on here.

This idea of the wisdom of crowds has been extensively explored in academia over the past several decades. One such classic example is asking a crowd to guess how many jelly beans are in a jar. Economists and sociologies have now run this experiment many times, over the years. Perhaps the most famous example is the experiment by finance professor Jack Treynor, who ran the experiment on his class. He had a jar of 850 jelly beans. His class of 56 guessed an average of 871, and only one of the students was closer to the actual number than group-averaged guess.

So what does this have to do with investing? Stock markets are really just the average of what a crowd of investors thinks the price of a stock should be. In fact, the current price of every security is simply the average best-guess of a very large crowd, many members of which are quite bright and have a lot of resources at their disposal to value investments. This is why it can be quite difficult to “beat” the market consistently over time. This is also why at Omega the core of your portfolio is a collection of market indexes, assuming the average of a lot of bright investors’ estimates is correct over time. This core of the portfolio then has a constellation of niche strategies that can complement the core over time by adding exposure for different States of the World®, additionally covering those cases when equity markets are flat or down.

Although crowds can provide some wisdom, they can also yield folly. Our history is replete with so-called panics and manias. Stock markets will sometime overreact with spectacular crashes and rises. And so do some other markets. The 17th century witnessed the first recorded version of a speculative market bubble via the market for Dutch Tulips.

Here is how Scottish journalist Charles Mackay described the period:

Many individuals grew suddenly rich. A golden bait hung temptingly out before the people, and, one after the other, they rushed to the tulip marts, like flies around a honey-pot. Every one imagined that the passion for tulips would last for ever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them. The riches of Europe would be concentrated on the shores of the Zuyder Zee, and poverty banished from the favoured clime of Holland. Nobles, citizens, farmers, mechanics, seamen, footmen, maidservants, even chimney sweeps and old clotheswomen, dabbled in tulips.

As has always been the case, bubbles almost never end well. At the peak of the tulip market bubble, a Viceroy Tulip was worth five times that of the average home.

Here is a Wikipedia image of the Viceroy Tulip:

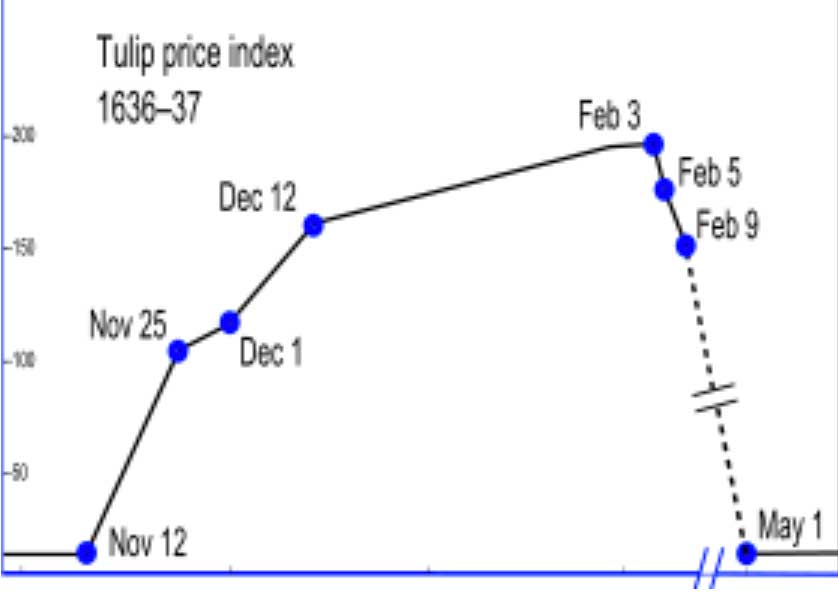

The Tulip is quite lovely, but I’m not sure it should purchase five homes. The below chart reports an index of tulip prices during the bubble, which began in the teens, and then sky-rocketed to almost 200 in just a few months. Unfortunately, most of the speculators entered into the market after its amazing ascent. By just a few months from the peak, the market had crashed back to where it had begun.

There are also some psychological underpinnings of the failure of groups. Groupthink, bandwagon effects, and group polarization are just a few such examples. And then there are individual biases and errors that do not go away when people are put in a group. In fact, there are entirely new fields in economics and finance named behavioral economics and behavioral finance, respectively, that attempt to correct many past findings that did not consider certain psychology factors in decision making. A recent example of group folly that I’ve witnessed, now that my daughter is a high-schooler, is some of the fashion choices of crowds. However, I would need a whole different commentary for this topic.

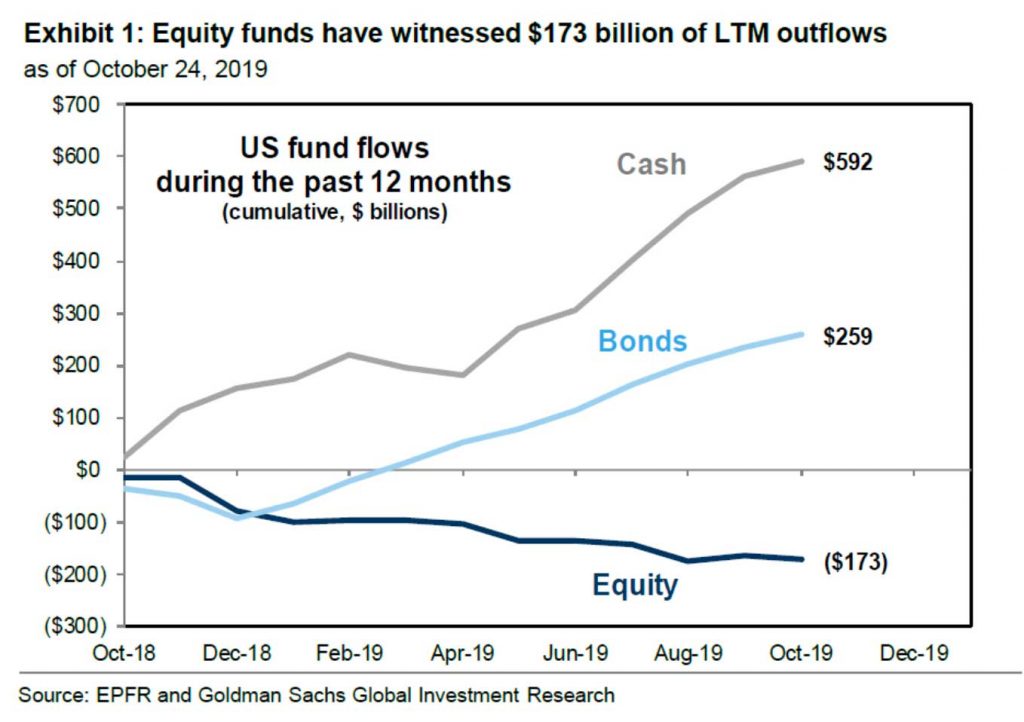

So sometimes the crowds are quite right, and yet at other times, they are quite wrong. However, at times the crowds are quite wrong in predictable ways. A final example I’ll provide in this vein is the timing of the investors. The average individual investor tends to buy high and sell low. For example, over this past year, investors have pulled a net 173 billion out of stock funds (including ETFs) and piled the bulk of their money into bond and money market funds, as the below chart illustrates:

Has this represented wisdom or folly this year? Well, year-to-date, many equity markets are up close to 20%, whereas money market is still about zero and bonds are up close to 10%. A basic weighting of 50/50 stocks and bonds would have yielded close to 15% year-to-date. In contrast, the average weighting of actual investment over the past months would have yielded a loss of just over 1%. Investors on whole have been essentially going short equities to invest in lower- returning cash and bonds.

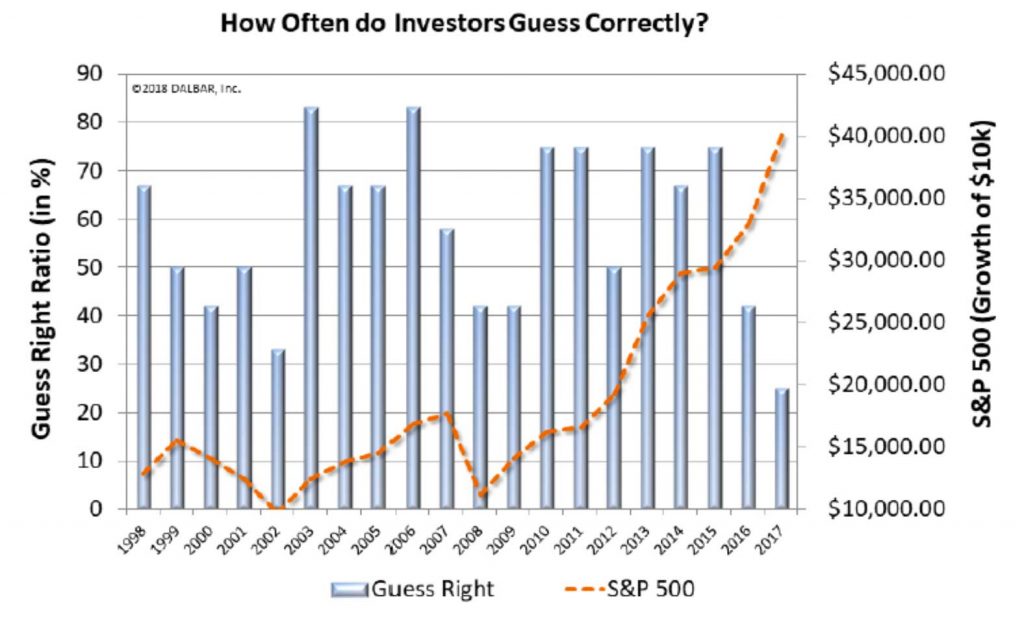

Is this investor crowd mis-timing unusual? Nope. The below chart shows that when it comes to investing before stocks go up and divesting before they go down, investors are correct about 50% of the time. So you could either follow the ways of the crowd or simply toss a coin to determine your next investment move, as either approach yields equally poor results. Similar results can be obtained following investors across other types of investments besides stocks.

So what do we take away from all of this? Sometimes following the crowds can help us and sometimes it can hurt us.

I leave us with five final take-aways regarding crowds:

- Most often simply capturing market returns through exposures to index and engineered index investments will be the most successful approach.

- Some uncertainty can be resolved through robust prediction markets.

- Rather than copying the crowds’ attempt to predict the various market and economic outcomes, prepare for them through strategic exposure to the different possible outcomes.

- Be leery of each exciting new trend.

- Resist the argument “I should be able to do this because ‘everyone’ else is,” especially if the person with the request is a teenager…

Omega Financial Group LLC is a Registered Investment Adviser. This commentary is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Omega Financial Group LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Omega Financial Group LLC unless a client service agreement is in place.