“I didn’t expect this.”

Keith Gill, the day-trader credited with starting the GameStop stock mania

“This is actually good news.”

Dr. Anthony Fauci on the Johnson & Johnson preliminary vaccine results

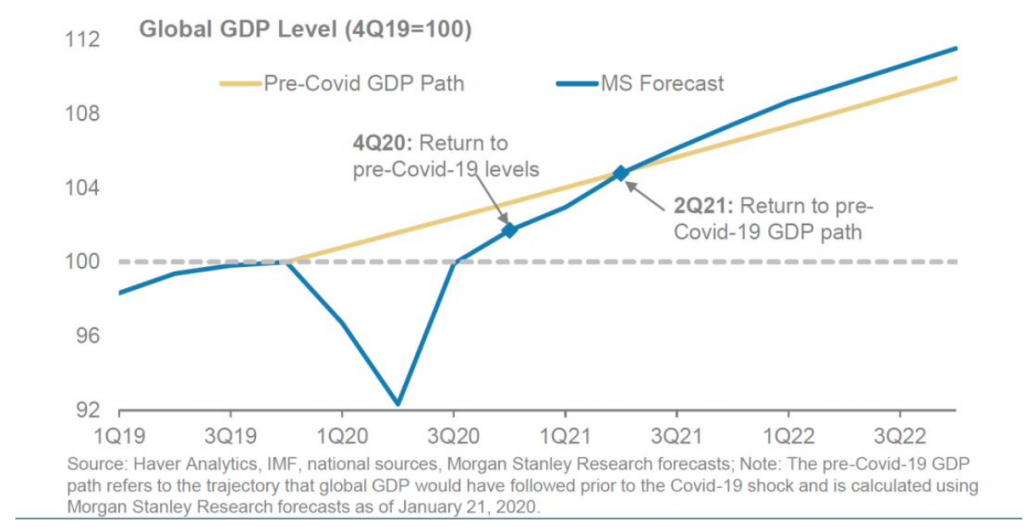

When the year 2020 closed out, I heard many comment on their excitement for a New Year. And rightly so; 2020 was a strange, confusing, unexpected, and tragic year, one we’d like to put behind us. Although COVID-19 brought the world economy to an unprecedented grinding halt, through massive fiscal and monetary stimulus, the economy also recently experienced an unprecedented bounce back to pre-COVID-19 economic growth. This economic trajectory created a so-called V-shaped recovery, as shown in the following chart:

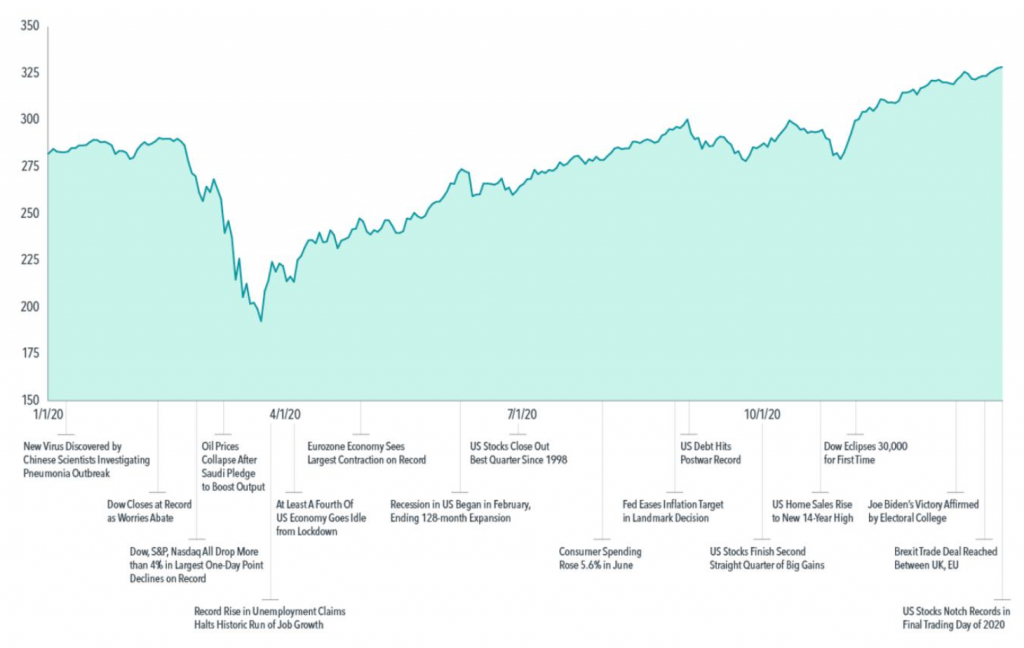

Now that the economy is growing again, we are expected to return to our The yellow line represents the forecasted level of global economic growth (i.e., GDP) over time had there been no COVID-19. The blue line charts what actually happened through 4Q20 and then a forecast of what will happen, according to Morgan Stanley estimates. As can be seen, after 2Q21, the actual economy should be growing at a greater pace than had COVID-19 not happened, and eventually likely makeup for most of what was lost economically. A key to this forecast is that we continue to vaccinate the world to allow for an ultimate return to some form of normalcy—more on this later. The global stock market, naturally, anticipated the current economic recovery, creating a “V” of its own before the economy did. The following chart shows the path of global stocks over 2020, while notating various important events.

Just as we hoped that we were firmly on the road to normalcy, this past week, we witnessed a colossal so-called short squeeze, most prominently shown through GameStop stock. You might wonder what is a short squeeze? There have been myriad social media posts from TikTok to YouTube offering various explanations, and some are quite confusing if not outright wrong. I will hazard my own explanation.

To begin, one must understand what a “short” is. When investing in stocks you can go “long” or “short.” Going “long” simply means you buy a stock in hopes that it goes up in value. So, for example, maybe you bought Apple’s stock for $100 and sold it for $130, making a tidy profit of $30. If instead you sold the Apple stock at $80, you would have lost $20. In contrast, going “short” reverses the order of this pursuit of profits. For example, you sell the stock for $100 and instead hope it goes down to $80, at which time you can buy it back and be done with the trade having made $20 of profit. If instead you sell Apple at $130, you now would have lost $30. How can you possibly do this buying and selling in reverse? The trick is that you actually borrow stock from some another investor. After having borrowed it, you can then sell it. However, there is a catch; now, you have to someday pay back the investor’s stock. This is why you buy the stock back to close the trade, as you are repurchasing shares to have to give back to the investor from whom you borrowed the shares to short sale them. There is also a little interest paid on the stock loan and a little interest earned on the cash generated from the proceeds of the stock short sale, but we will ignore this part for simplicity.

Although most individual investors only go “long,” many hedge funds and other institutions regularly go “short” as an opportunity for additional profit and also to manage risk by hedging. For example, let’s assume in addition going “long” Apple, you went “short” Google stock. Assuming roughly equal amounts of going “long” and “short,” if the market goes up, you’ll make the difference in returns between Apple and Google stock. So, if investors like Apple more as a stock versus Google, the Apple stock will tend to go up more than Google’s, generating a net profit (i.e., the increase in Apple stock price minus the increase in Google stock price). In contrast, if the stock market starts falling, both stocks will likely fall in value. However, you will lose less money being “short” Google in addition to being “long” Apple because you aremaking money if the Google stocks goes down, partially offsetting your loss on your Apple stock as it goes down too.

That all sounds fine, but what is a short squeeze? The problem with being “short” is that if the stock you short goes up and you want to manage risk, you will need to buy back some shares to make sure you don’t have too much of your portfolio “short” that stock. For example, if you went “short” $100,000 of Apple stock and the stock has a 10% rise in value, you now have $110,000 “short.” Thus, you would need to buy back $10,000 worth of stock to get the exposure back to $100,000. The problem becomes that if there are a lot of investors “short” the stock, when the stock goes up, there is not one but many investors buying back shares to manage risk exposures. However, this creates a snowball effect where those same investors need to buy back even more shares to continue to keep the same exposure. The end result can be the value of the stock rising tremendously and consequently the investors “short” the stock losing a lot of money. This is the so-called infamous short squeeze. To identify how likely this is to happen, there is a measure called short interest, which reports the level of shares that are currently held short. The greater the short interest, the greater the chance of a short squeeze. As might be expected, it is only smaller companies that are likely to be subject to a short squeeze, as a very large company (e.g., Apple) would need to have too many short investors to realistically be able to make a difference on its price.

The company GameStop’s stock this past week was the subject of a dramatic short squeeze, which was featured across most all major news outlets. The below charts show the dramatic swings of GameStop’s stock price, plotted against the Russel 2000, the US small stock index to which it belongs. Both lines are normalized to beginning the 7 days at 100:

The white line is the price of GameStop over the past 7 trading days of January where it grew over 700% and the green line is Russel 2000, which in comparison looks like a flat line though it fell in value by over 4% over the same period of time. What makes this story especially interesting is that the short squeeze was apparently started by a band of small investors with the very clever idea to go after one of the most shorted stocks. Many institutional investors had thought GameStop was on its way to the final stop of bankruptcy, based on its being a bricks and mortar store that had been pushed to the brink from COVID-19 shutdowns. Through forums such as Reddit, ultimately 100,000’s of investors apparently organized to start buying shares to run the price up, knowing that it would cause a short squeeze, even further running the price up. A strong undercurrent was also the idea to punish the large institutional investors, who always seem to have an unfair advantage over the “little guy” retail investor.

The Wall Street Journal (WSJ) published an insightful piece this past weekend interviewing Keith Gill (see picture below), who is credited with starting this GameStop coup. It turns out that he was mentored by an investor his aunt introduced him to and he also obtained his Chartered Financial Analyst (CFA) credential, which usually takes three years to complete and carries a lower than 50% passing rate. The CFA is held by many top professional senior stock analysts. According to the WSJ, Mr. Gill had over $30 million in his account as of last Friday. For this particular David and Goliath story it seems David is especially well-equipped to lead the charge, with a ragtag army to follow.

Not only is this David clever, well-capitalized and expert (e.g., it’s reported he also shorts stocks), he is also very entertaining, as can be seen simply from the above picture. Well- equipped with wristbands, a headband, and mug of beer, he captures the imaginations of 100,000’s of investors ready to make a quick buck. His alias’ include DeepF—ingValue and Roaring Kitty. Parenthetically, I do wonder if this drama would have happened in “normal” times without so many people stuck at home because of COVID-19.

Whatever the case, a huge band of followers has formed, and they have this past week pursued other companies such as AMC Entertainment and Bed Bath and Beyond that were hurt by COVID-19 shutdowns (and were thus highly shorted by institutions due to their having poorer financial prospects). Because of all this volatility, some Omega investors have been wondering what this all means for them. The short (!) answer is, not a whole lot. This short squeezing has been quite entertaining and even humorous at times. However, Omega’s exposure to these particular securities is de minimis. So enjoy the stories, but do not be troubled about its link to your personal financial situation. What does matter, however, is our progress in inoculating the world against COVID-19.

Not only does vaccinating matter for our personal health and safety, it also matters greatly for the global economy. The economic malaise of this past year can be linked entirely to the COVID-19 pandemic. Thus, so is its recovery linked.

Where are we at with our vaccination progress? Unfortunately, we have gotten off to a slow start, being short syringes and the vaccines to go in them. Even so, the US, UK, and Israel are leading the way. However, this lead is not enough. In the US, total doses given as a percent of our population is about 8%, with most of these being the first of two doses. California is also at about 8% and here in Santa Barbara County we are a bit behind at 7%. Experts suggest we need 60-90% of people inoculated to reach herd immunity, depending on one’s assumptions. However, it is generally believed if someone has already had COVID-19, they should enjoy immunity, though its duration is not known. In the US it is estimated 20-25% have already had COVID-19, based on fatalities. In Santa Barbara county, using the same approach, it is estimated that only about 12% of us have had COVID-19. Thus, we could potentially reach herd immunity

reasonably sooner than if only tracking vaccination rates. Nonetheless, we still have a way to go.

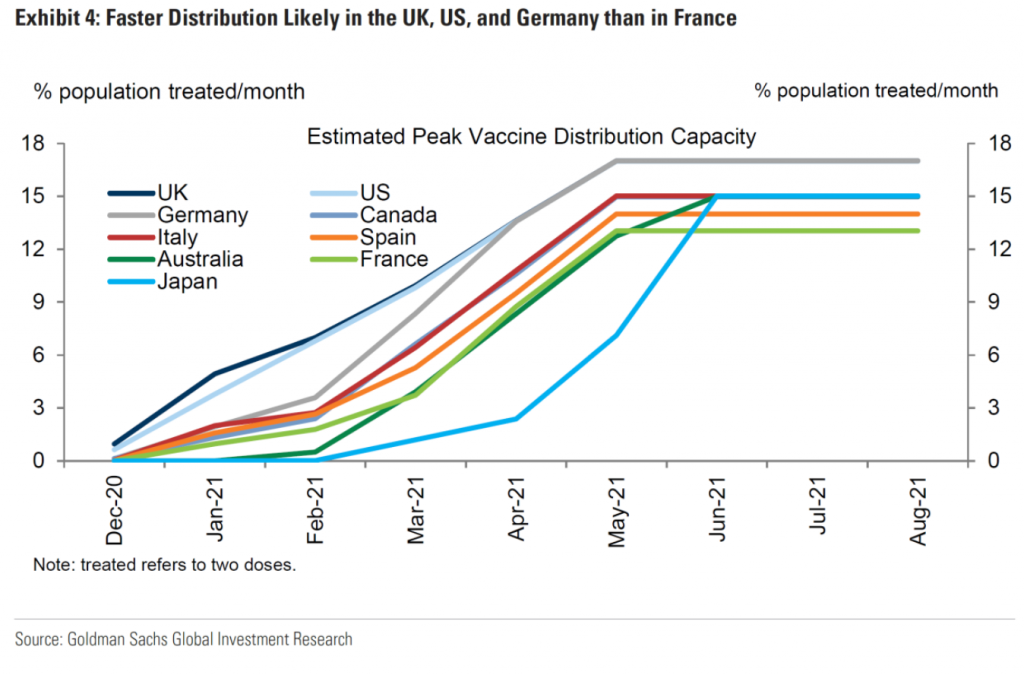

But there is hope. Goldman Sachs recently estimated our ability to vaccinate based on historical flu vaccinations, current potential vaccination networks in the US, and the current experience of other countries. While the current leader Israel has been vaccinating 25% of its population monthly, it is expected we can get to about 17% monthly by mid-Spring. The below chart reports this scenario along with the expected vaccination path of major developed countries, which have largely gotten off to a slower start:

So what does this all mean in terms of reaching some place of normalcy? These forecasts suggest the US can provide 50% of the US a first dose of the vaccine by the end of May, which means their final dose by the end of June. This, coupled with those that have already had COVID-19, suggests by this Summer we can be approaching a return to normalcy.

Of course, there are new variants of the coronavirus around the world, as would be expected after over 12 months of viral spread. The good news is evidence shows that the current vaccines we are using are relatively effective against these new variants. In addition, both Moderna and Pfizer are already exploring ways to tweak booster shots to provider even stronger immunity against these new variants. All the while, we just had two new vaccine candidates provide updated clinical results. Additional vaccines will further increase the rapidity of vaccination.

So in the end, my mainline forecast is that sometime this Summer we can gather in person for a celebratory Omega event. I’m already exploring some different wine and cheese options at home for which I hope to share with you this Summer. I hope that you too are doing the same…

Omega Financial Group, LLC is a Registered Investment Adviser. This commentary is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Omega Financial Group, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Omega Financial Group, LLC unless a client service agreement is in place.