Since the deepest valley of the pandemic, it seems like most everything is going up: some great things and some not so great things. In this article, I highlight five of the most important rising tides, in my view.

Fraud

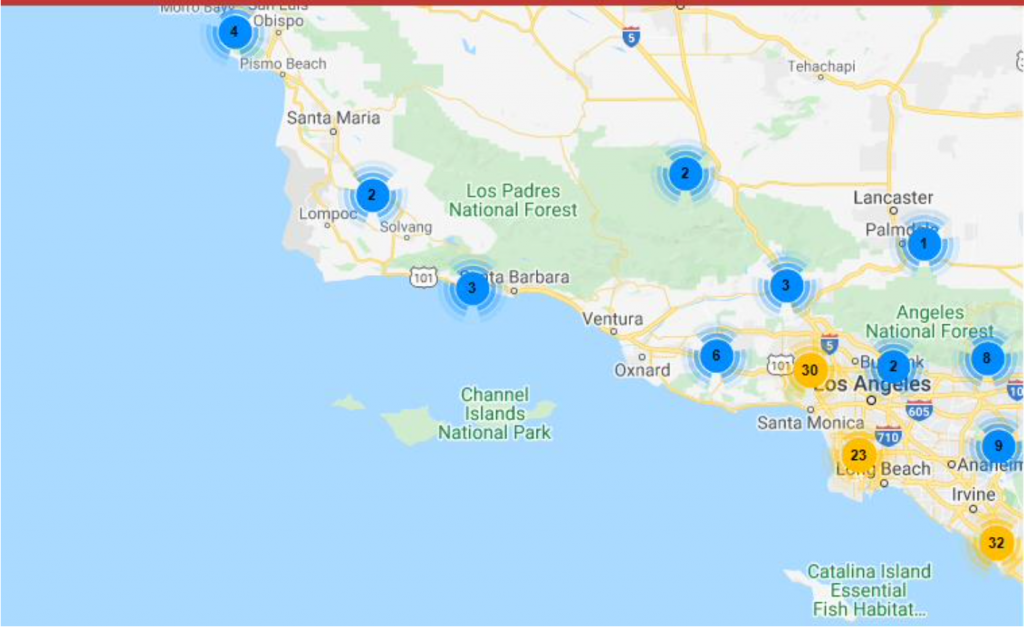

One of the disadvantages of living a largely virtual life is it has become easier for fraudsters to go to work, as most everything now resides online, post-COVID. Indeed, the US Department of Justice reported already over 1⁄2 billion dollars of losses for known COVID-related frauds. While some of this fraud was people attempting to indirectly take money from us through inappropriately seeking government assistance, a lot of fraud has occurred with direct attempts to steal from us, ranging from bogus vaccine schemes to government payment scams. Interestingly, AARP has created a map that can be used to identify recent user-reported scams, as shown below:

Each circle represents a scam and can be clicked on to find further details. This map can be found here. More broadly AARP’s website, is the most comprehensive I have found to provide information on how to avoid becoming a victim of fraud. I highly recommend exploring this part of their website.

We have even had several Omega Financial Group clients become targets of large and successful fraud operations; fortunately, we were largely able to thwart the criminals’ efforts due to swift and early action. We thus highly encourage you to do three things in this regard:

- Never respond to an email and incoming phone call. Instead, only directly call a company and go to its known websites directly. Email phishing and fake caller ID is rampant now. That is, it is easy for a fraudster to choose a certain caller ID to appear on your phone or to send you an email with official looking company email to which they ask you to respond.

- Never give out account and personal information unless you have initiated to do so with a well-known person and/or company.

- Follow your gut: if you ever feel uncertain about a transaction or conversation, please call our office (805) 617-4363 immediately.

Inflation

There has been a lot of recent news on inflation. Unlike fraud, inflation is like many things: in moderation, it is a good thing. Inflation is usually a part of healthy economic growth; it reflects increased demand beyond currently available supply. This then means economic activity needs to be increased to meet the increased demand, which, through a multiplier effect, can raise many parts of the economy at once.

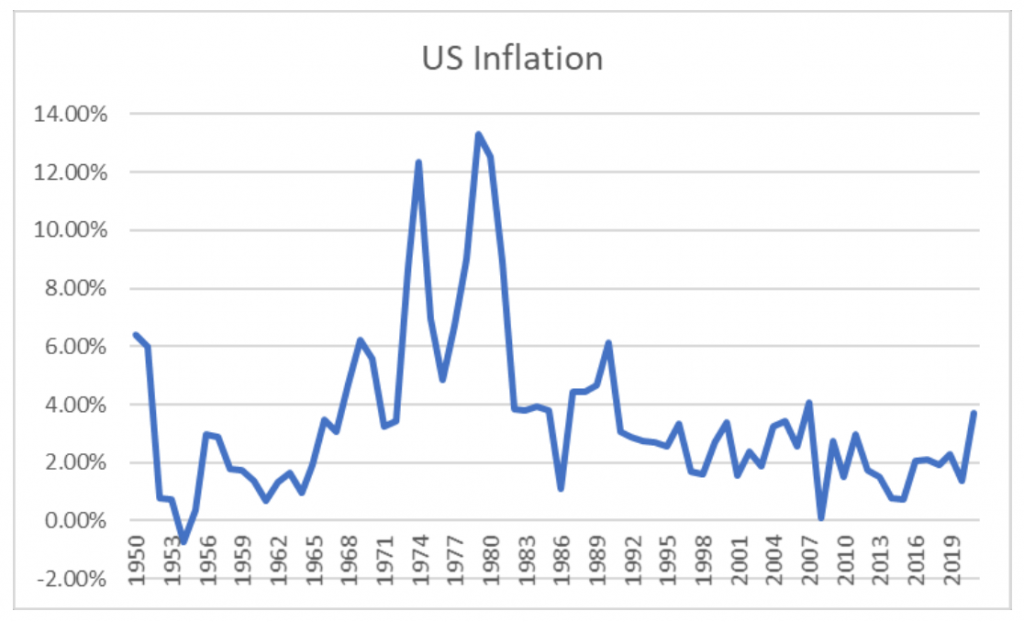

The Federal Reserve has sought to have US inflation reach 2% per annum for some time. Year- to-date overall inflation is up almost 4%. While this might seem startling, the large number is due to base effects (starting from depressed economic points), constrained supply (from lower COVID-era production), and increased demand from improving employment and stimulus checks. All of these three forces should work themselves out in the coming year, in my view. The chart I created below provides a historical context of inflation over time, since 1950:

In the long run, we use roughly 2.5% per annum as a reasonable inflation expectation. My mainline forecast is for us to not materially exceed that, on average, in the coming decade. And this is also the inflation rate that we have been using for your strategical financial plans.

Two ways to hedge against inflation from a personal financial standpoint is to have sufficient equity exposure, as the value of companies due tend to go up over time, even during inflationary periods. The other way is to have some exposure to commodities, which we do, and have happily had a large payoff this year.

Interest Rates

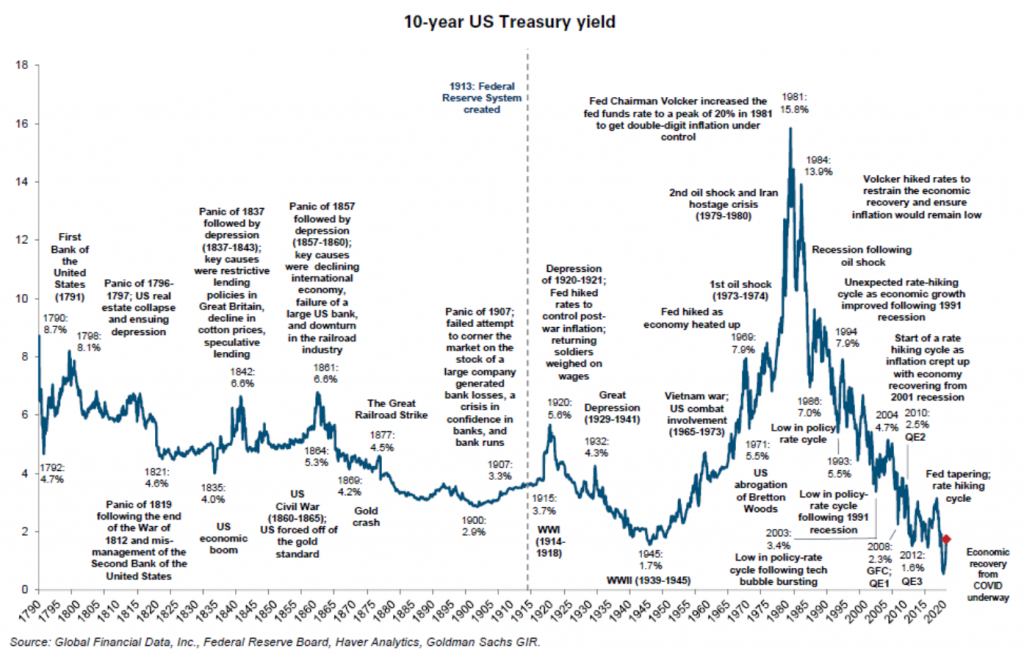

Tightly linked to rising inflation is rising interest rates. After all, if we loan a sum of money, the higher inflation, the less we actually receive when we are finally paid back. Thus, we ought to demand a higher interest rate if being paid back during a higher inflationary environment. Below is a historical chart of the often-watched US government 10-year bond yield, from 1790 to now (noted by the red dot).

All of the (admittedly busy) text on the chart simply chronicles the many events surrounding yields rising and falling. The most relevant take-away is the historical perspective of interest rates. Although, yields have risen some this year, we are still at very low levels historically. Going forward, I only expect a modest further increase in yields.

As bond yields rise, the current value of a bond falls, as this investment must continue to pay the equivalent of the current market yields to anyone that would then purchase that bond. To ameliorate this dynamic, since many of us have a material exposure to global bonds, we have been doing two things: we have been tilting our bonds towards short-term bonds, which actually benefit from rising rates, as short maturities rapidly rollover to new larger yielding bonds, and we have been investing in private credit, which typically provides much higher yields and is fairly insensitive to rising rates due to its idiosyncratic nature.

Vaccination Levels

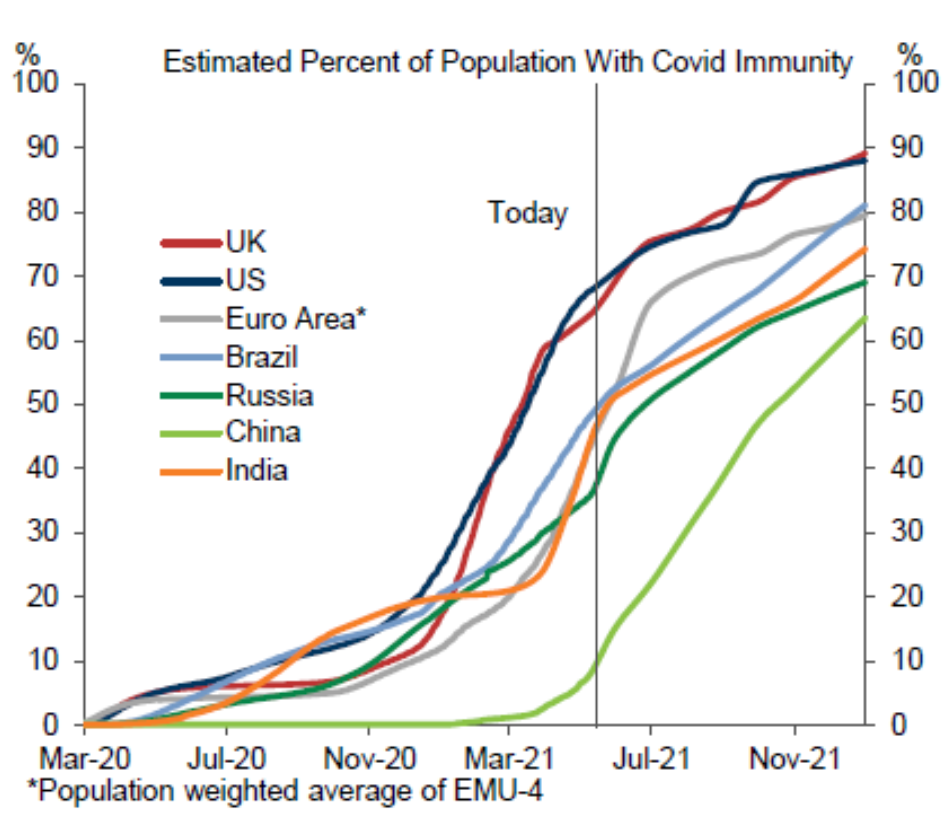

One of the most important things that has been going up this year has been vaccination levels. Here is a chart that shows our current progress towards COVID immunity, along with a forecast, which includes estimated levels of past infection as also providing immunity:

The state of California, being more cautious than the CDC and the Biden Administration, has decided to wait until 6/15 to heed the current CDC guidance of largely shunning masks for vaccinated individuals, as well as eliminating capacity restrictions on business. Assuming the state follows through on this plan (as there have been many changes through this pandemic (!)), it should provide another positive jolt for business and the economy.

Pop Up Wine Bar

We are very excited to have a wine bar pop-up going up in the courtyard next to our Omega offices to celebrate our in-person reopening in July. We plan on sending out invitations next month. It should prove to be a time of great wine, cheese, and cheer. We’ve been working hard on finding some nice wine and cheeses (yet another reason I love my job!).

Meanwhile, should you have any questions or concerns about anything else that seems to be going up (or down, for that matter), please don’t hesitate to reach out to us!